Some of the terminologies used in Forex are different from those in stocks. In stocks, we measure price change in dollars and cents and percentage. In the world of Forex, currencies move in cents or less. The change in price is measured as pips instead.

You must have realized that the quotes of some currency pairs are displayed differently. Some quotes are displayed up to 3 decimal places while some others are displayed up to 5.

Example: EUR/USD

Example: USD/JPY

EUR/USD has 5 decimal places displayed, with the 5th decimal in a smaller font size.

USD/JPY has 3 decimal places displayed, with the 3rd decimal in a smaller font size.

#1 What Is A Pip?

A pip is the unit of measurement to express the smallest denomination change in value between

2 currencies. Most currency pairs are usually trading at 4 decimal places (ignoring the number that’s in a smaller font size) except for Yen pairs. Yen pairs are at 2 decimal places (ignoring the number that’s in a smaller font size).

Is there anything smaller than a pip? Yes! It is called a pipette, which is commonly known as fractional pips.

Pipettes are those numbers shown in a smaller font size. Why are pipettes good? They allow you to trade with tighter spreads, effectively reducing your cost of trading!

Test Yourself

Using the example above, GBP/USD is trading at 1.30543. When the value of GBP/USD rises to 1.30556, how many pips has this currency pair risen by?

The answer is..

1.3 pips! Did you get that right?

#2 How Much Is A Pip?

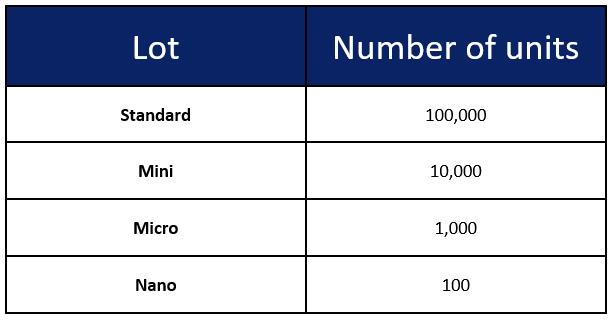

Forex is a leveraged instrument, so it is common for amounts in the thousands and tens of thousands to be traded by the retail traders.

Let’s assume the following:

- You trade 1 standard lot (100,000 units)

- USD/JPY is trading at 119.80

Using the formula, it works out to be USD8.34 per pip.

Here’s another example:

- You trade 1 min lot (10,000 units)

- USD/CHF is trading at 1.4555

Using the formula, it works out to be USD0.69 per pip.

Conclusion

The knowledge of calculating pips comes in handy when you are deciding which Forex pair(s) to pay particular attention to. You want to maximize your trading capital and factor in opportunity cost.

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Join us in our Facebook Group and share your questions as we learn and grow.

#2 Never miss another market update; get it delivered to you via Telegram.

#3 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only).

See you around!