Did you know that the market is stuck in a range most of the times? In other words, you will see the rectangle chart pattern 70% of the time. This leaves trends to form the other 30%. Hence it is important to know the significance of the rectangle chart pattern.

Why Does The Rectangle Chart Pattern Occur So Often?

A rectangle occurring after a trend is normal. Rectangles are resting areas. This is an area where the bulls and bears are unable to overcome one another, resulting in a trendless situation.

I’ll be using the chart of Apple throughout this article.

Identifying The Rectangle Pattern

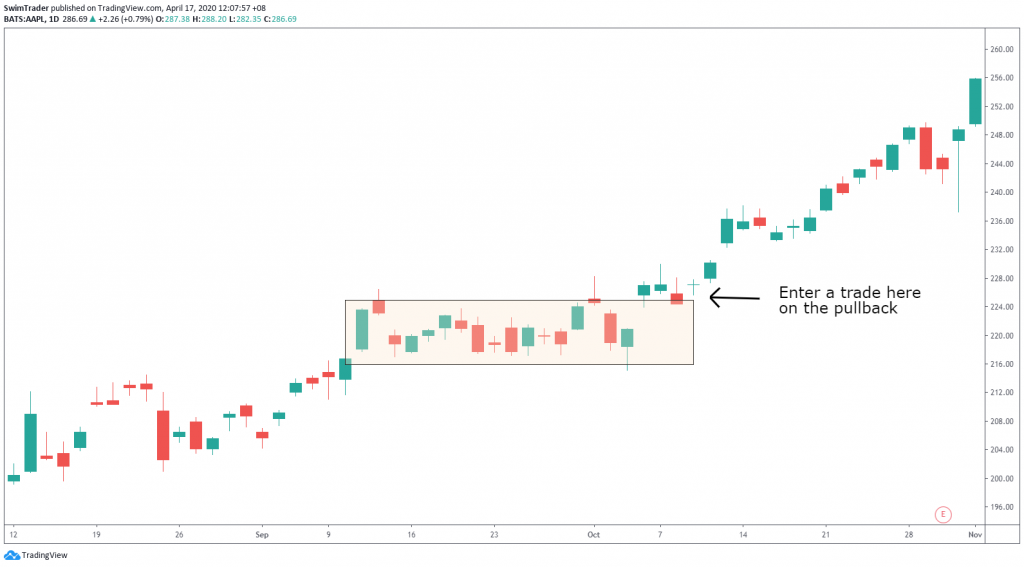

Given that rectangles are areas of rest, they should ideally be narrow and tight as shown in the chart below.

Did you notice that the horizontal lines of the rectangles act as support and resistance?

Prices may pierce through the support resistance lines, but the general rectangle pattern is still well respected.

Size

A rectangle can last for a short while to several years. Trend traders look for rectangles that last for several days to months.

Besides varying in duration, rectangle chart patterns also vary in height.

A rectangle is like a base of a building. A larger base will be able to support a larger building. Therefore, a larger rectangle will be able to support a larger price move when prices break out of the rectangle.

The larger the candles within the rectangle, the longer the pattern stays in a rectangle. The move following the breakout of the taller rectangle tends to be larger.

Compare the examples below.

The size of the above rectangle is $9 . Price hovered within the rectangle for 7 weeks and continued up once it broke out of the rectangle.

Let’s replace the above chart with a larger rectangle.

The size of the second example is $11 . See how much more powerful the down move is!

What Happens Inside The Rectangle?

Accumulation and distribution take place within rectangles.

At market lows, institutional investors will be accumulating (buying) the asset and this can occur within the rectangle pattern.

At market tops, institutional investors who bought the stock while it was cheap will slowly distribute (sell) to uninformed investors.

In short, rectangles are battle zones between buyers and sellers.

You can find this pattern in all market types. How then, can we trade and profit from this rectangle pattern?

Show Me The Money

The old adage, the trend is your friend, is followed by many professional traders. Thus, to increase your profitability, you should trade after prices have broken out of the rectangle.

I recommend creating a separate watchlist of stocks whose prices are stuck in a rectangle and KIV them. Review them every few days and transfer them out to another watchlist when prices have broken out.

There are 2 ways to trade a breakout from rectangles:

#1 Breakout trade

- Watch for price to break either the top or bottom of the rectangle.

- Enter a position according to the direction of the breakout the next session

- If you are trading using the hourly chart, enter the trade an hour later.

- If you are trading according to a daily chart, enter the trade on the next day.

#2 Pullback trade

- Watch for price to break either the top or bottom of the rectangle.

- Wait for the price to pull back to the area near the rectangle and enter a position the next session

- If you are trading using the hourly chart, enter the trade an hour later.

- If you are trading according to a daily chart, enter the trade on the next day.

Remember that the move following the breakout of a larger rectangle tends to be bigger? Set your profit target according to the size of the rectangle.

Conclusion

Trendless price movement results in a rectangle chart pattern. We can be prepared for its next move and only enter a trade when prices have broken out of it.

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Register for our market outlook webinars by clicking here

#2 Join us in our Facebook Group as we can discuss the various ways of applying this by clicking here

#3 Never miss another market update; get it delivered to you via Telegram by clicking here

#4 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

Trade safe!