The stock market has been making new highs. The S&P 500 has soared by 75% since March 2020. The question on everybody’s mind is if a mini crash is around the corner. After all, bearish calls and reports have been surfacing lately.

Instead of depending on commentary (which can be biased), you can rely on a more objective way to spot potential bearish reversals.

You’ll learn 4 different bearish reversal candlestick patterns in this article and let’s head right in to it!

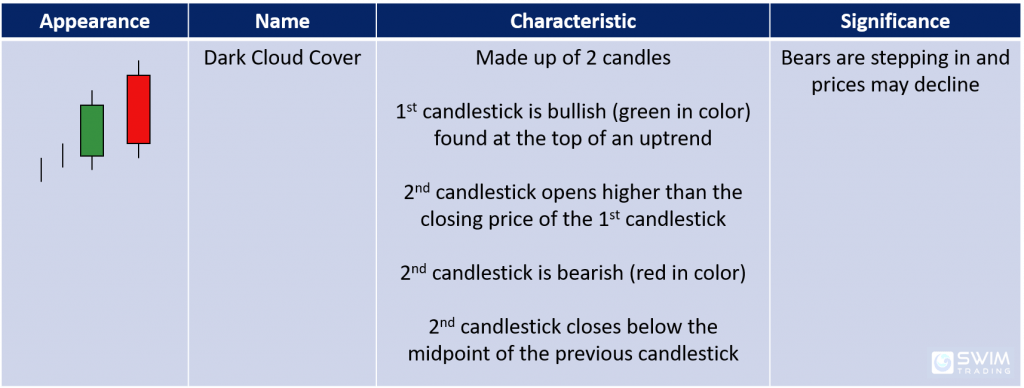

#1 Dark Cloud Cover

How does the Dark Cloud Cover bearish reversal candlestick pattern look like? What are its characteristics?

The 2 vertical lines before the Dark Cloud Cover pattern represent the range of the previous candles. The previous candles’ color, shape and size are not important. The most important thing to note is that the prevailing trend MUST be an uptrend.

The 2nd candlestick must gap up at the opening and close below the midpoint of the previous candlestick.

Trading Psychology

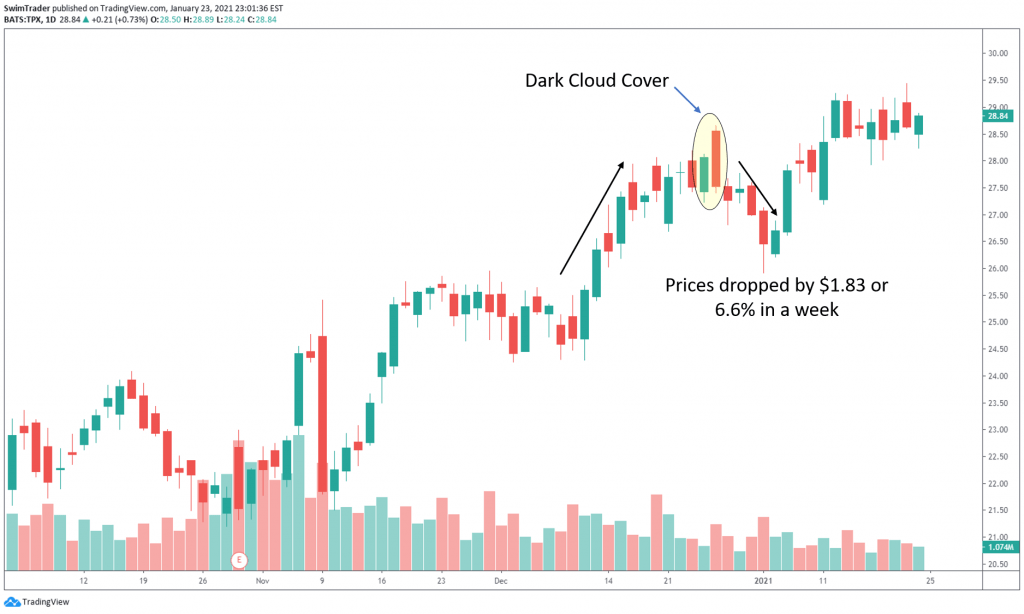

This bearish candlestick reversal pattern can be found in the chart of TPX in late Dec 2020. What were the market participants thinking and feeling then?

The bulls were having a good time; the market participants were highly optimistic of TPX. That sent the prices of TPX higher and higher until it reached $28.50 in late Dec 2020.

The mood of the market participants shifted on that huge red candlestick. The day started off well when the price of TPX gapped up on the opening. However, the bears took full control from there on and sent prices lower. The price of TPX eventually closed much lower of the midpoint of the previous candlestick.

Sensing fear, the pressure to sell was high. That sent prices tumbling down by 6.6% in a week.

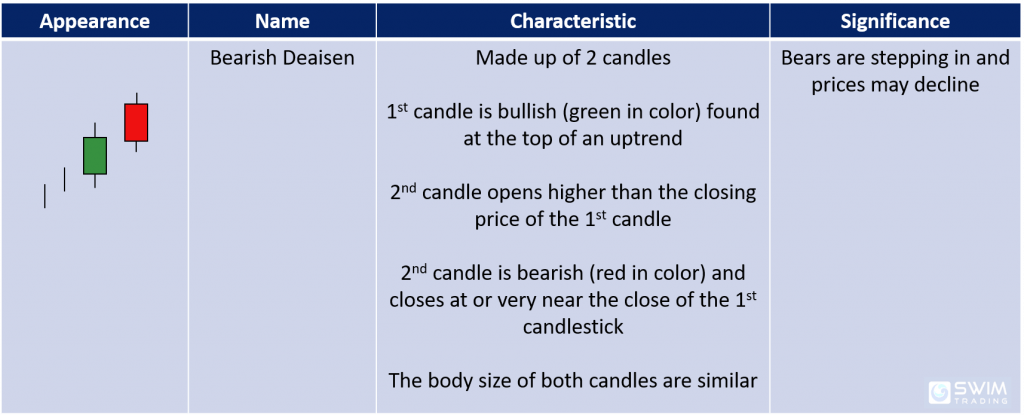

#2 Bearish Deaisen

This is the direct opposite of the bullish deaisen candlestick pattern.

The trend prior to the formation of the bearish deaisan candlestick pattern must be up. The body size of both candles should be similar.

Trading Psychology

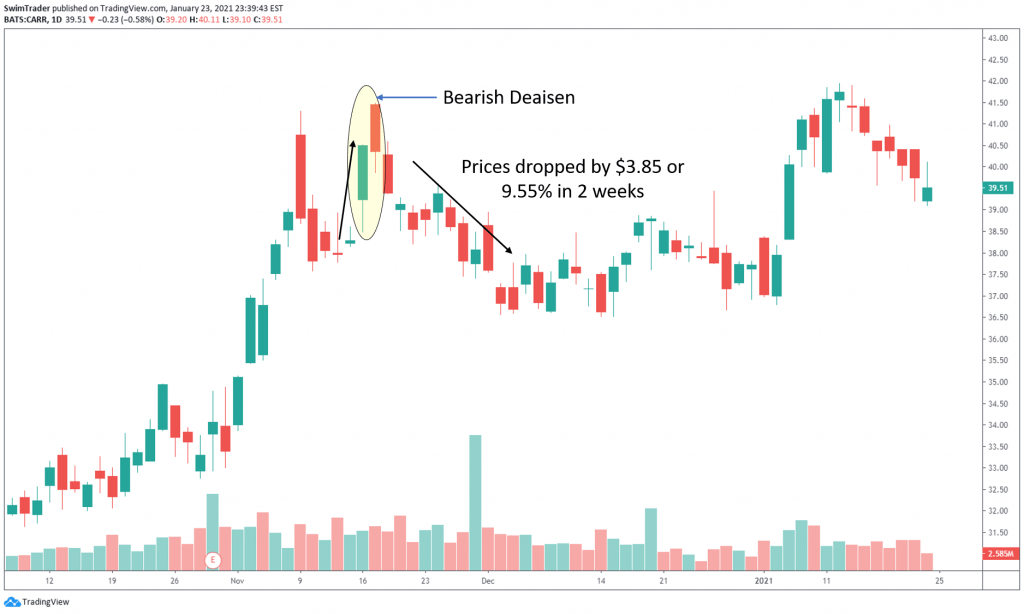

Let’s unpack what went on in the minds of the market participants in the case of CARR.

Prior to the huge run up, the market participants weren’t quite certain if CARR was worth the buy. This is inferred from the dojis.

Eventually, the bull won a tough fight and a huge green candle was formed. Did you notice that it has a long wick? This meant that the bears stepped in to push prices down before being overcome by the bulls.

The bullish sentiment continued the next trading session as the price of CARR gapped up. This time, the bulls couldn’t hold on to their fort. The bears overcame the bulls to close at the closing price of the previous trading session.

Bearish sentiment is strong and the bears continued to push their way through, pressing prices down by 9.55% in just 2 weeks.

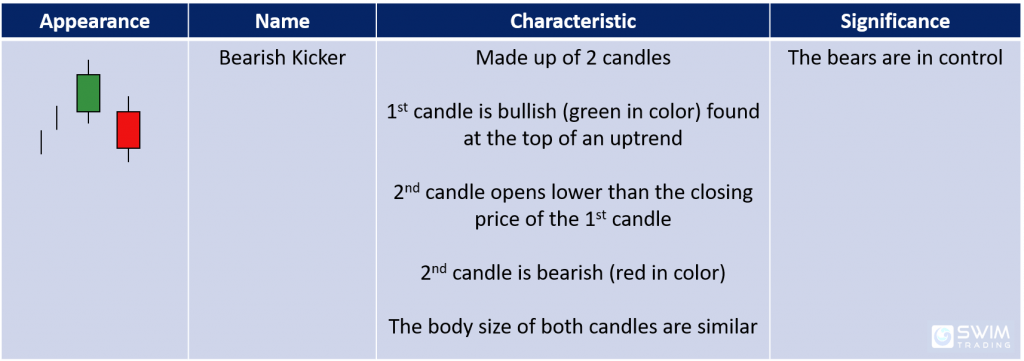

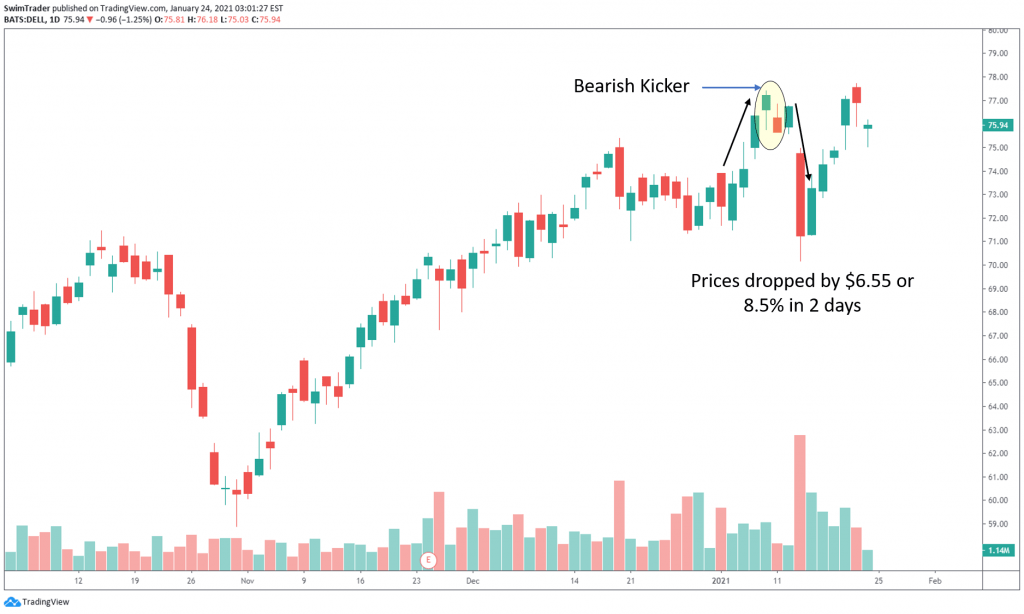

#3 Bearish Kicker

This is the direct opposite as the bullish kicker candlestick pattern.

The prior trend must be an uptrend. The 1st candlestick must be bullish, while the 2nd candlestick must gap down and be bearish.

Similar to the bearish deaisen candlestick pattern, the body size of both candles should be similar.

Trading Psychology

DELL has been bullish for 4 trading sessions in a row before the bearish kicker candlestick pattern was formed. There are signs that the bears were starting to crash the party, as shown by the wicks below the bullish candlesticks.

The lower wick on the last bullish candlestick is considerably long. This meant that the bears are starting to show its force and push prices down. This is confirmed by the next trading day when prices gapped down.

The bulls fought hard and eventually lost, leaving a top wick. The bulls launched another attack the next day but failed to gain much ground as prices collapsed by 8.5% in 2 days.

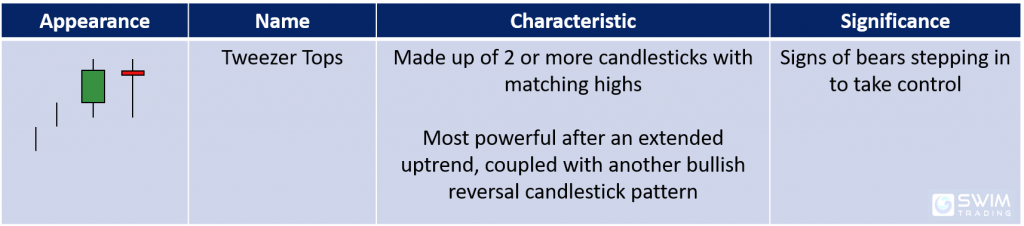

#4 Tweezer Tops

This is one candlestick pattern that’s easy to recognize.

The 1st candlestick should be bullish (green in color) while the 2nd candlestick should be bearish (red in color).

In the table above, the 2nd candlestick is a doji which indicates that the down move is likely to be strong.

Trading Psychology

The tweezer tops candlestick pattern appeared on the chart of FDX in late Oct 2020.

After a huge rally, the tweezer tops candlestick pattern appeared. This signifies a lack of bullish momentum as prices weren’t able to push higher. Given that the size of the 2nd candlestick’s body is large and that it had closed lower than the 1st, you can infer that the bears are in total control.

Price dived 9.75% in 8 days after the tweezer tops candlestick pattern appeared.

2 Things You Must Remember About These Candlestick Patterns

It is not important to memorize the names of these candlestick patterns. It is more important to know how to read candlesticks to trade successfully.

Here are 2 pointers that you must remember:

#1 The prior trend must be an uptrend

#2 The sequence of bullish and bearish candlesticks is important

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Register for our market outlook webinars by clicking here

#2 Join us in our Facebook Group as we can discuss the various ways of applying this by clicking here

#3 Never miss another market update; get it delivered to you via Telegram by clicking here

#4 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

Trade safe!