You are excited when the stock market goes up. You go on a buying spree. When the market drops, you get worried. As the market continues to slide, you get terrified. You hope that the slide is over before you get stopped out.

How do you know if the bulls are back to push prices higher? Can candlestick patterns help?

There are many signs of a bullish reversal which you can take advantage of to either buy or hang on to your stocks.

We’ll explore 3 bullish reversal candlestick patterns in this article.

Common Misconception

When you see a bullish reversal candlestick pattern, it doesn’t mean an immediate change to an uptrend. Think about how you drive.

When the amber light comes on, you can choose to speed up, slow down, or come to a stop. And if you choose to slow down and stop, you get ready to accelerate the moment the traffic lights turn green.

When you are looking to go Long, you want to spot bullish reversal candlestick patterns. When a bullish reversal candlestick pattern appears, get ready and wait for a good entry/buying point, just like how you wait for the traffic light to turn green. Always check and wait for a confirmation before you go Long because the price of the stock may either

#1 Change immediately from a downtrend to an uptrend;

#2 Change from a downtrend to a range; or

#3 Resumes the direction of its previous trend

Always remember that the trend is your friend, so only trade with the trend.

Now that you’re informed of this common misconception, you’re ready to proceed to discover these 3 bullish reversal candlestick patterns!

#1 Hammer

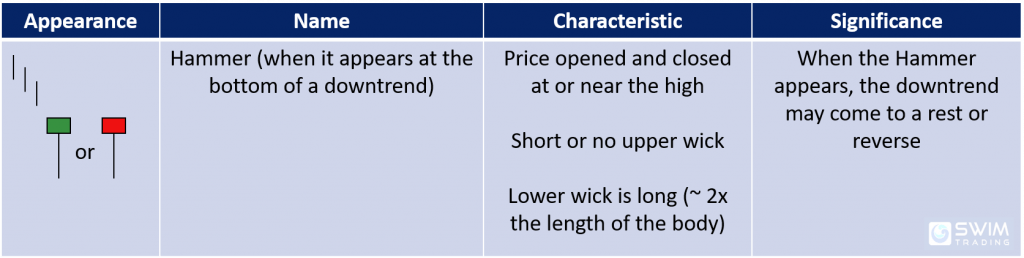

From the table below, you’ll learn of the 3 characteristics of a Hammer candlestick and its significance.

The 3 vertical lines before the Hammer represent the range of the previous candles. The previous candles’ color, shape and size are not important. The most important thing is that they are trending down.

I wish to add that for a Hammer to be a valid bullish reversal candlestick pattern, its opening price must be below the previous candle’s closing price (ie there’s a gap down). This chart pattern must also be formed at a low.

Trading Psychology

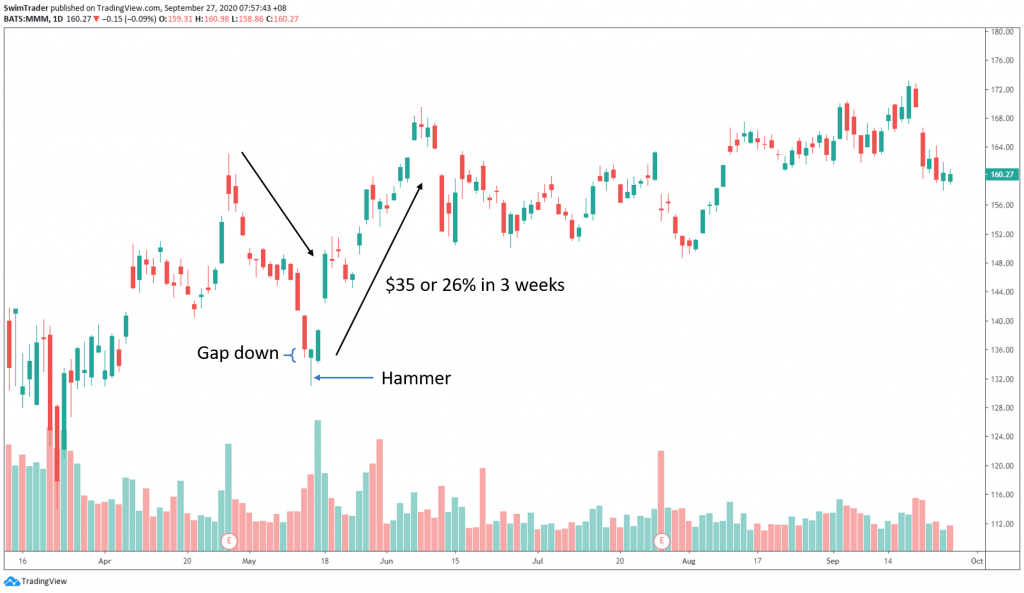

Let’s have a look at the Hammer candlestick pattern in real-life. The Hammer candlestick pattern appeared on the chart of MMM in mid-May 2020.

The Hammer candlestick can be bullish or bearish (ie green or red candle body) for that day, as shown in the earlier table.

In this example, prices didn’t range. They shot up immediately the Hammer bullish reversal candlestick pattern showed up. How much did prices shoot up? $35 or 26% in a short 3 weeks!

Let’s analyze what went on while the Hammer candlestick was being formed.

Price opened lower, and the bears continued to push prices even lower. The bulls decided to take over, pushing prices up. This forms the wick/shadow.

It was a fierce push down by the bears and then a superb fight back by the bulls. The bulls eventually won that day as the closing price for that day was higher than it opened (shown by the green candle body).

The Hammer candlestick indicates the relative weakness of the bears and the relative strength of the bulls. Prices are now ready to range of move upwards.

Pay attention to the volume too. A high volume day is a strong indication that the Hammer is a valid bullish reversal candlestick pattern.

#2 Bullish Belt Hold

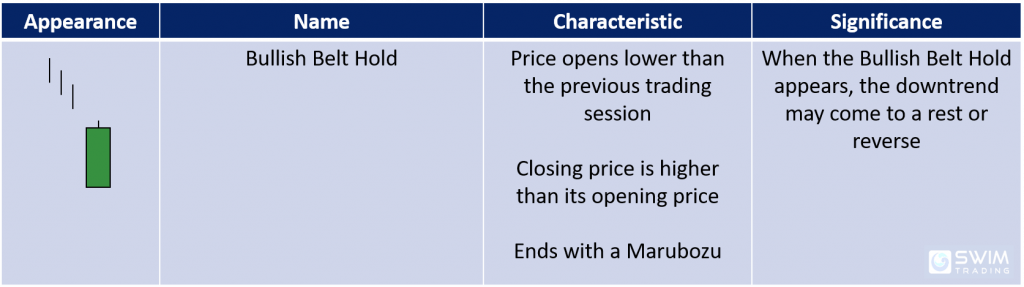

From the table below, you’ll learn of the 3 characteristics of a Bullish Belt Hold candlestick pattern and its significance.

The 3 vertical lines before the Marubozu represent the range of the previous candles. The previous candles’ color, shape and size are not important. The most important thing is that they are trending down.

Note that the opening price of the Marubozu must be below the previous candle’s closing price (ie there’s a gap down). A Marubozu is a fully green or red candle with very short or no wicks at the top and bottom. This chart pattern must also be formed at a low.

Trading Psychology

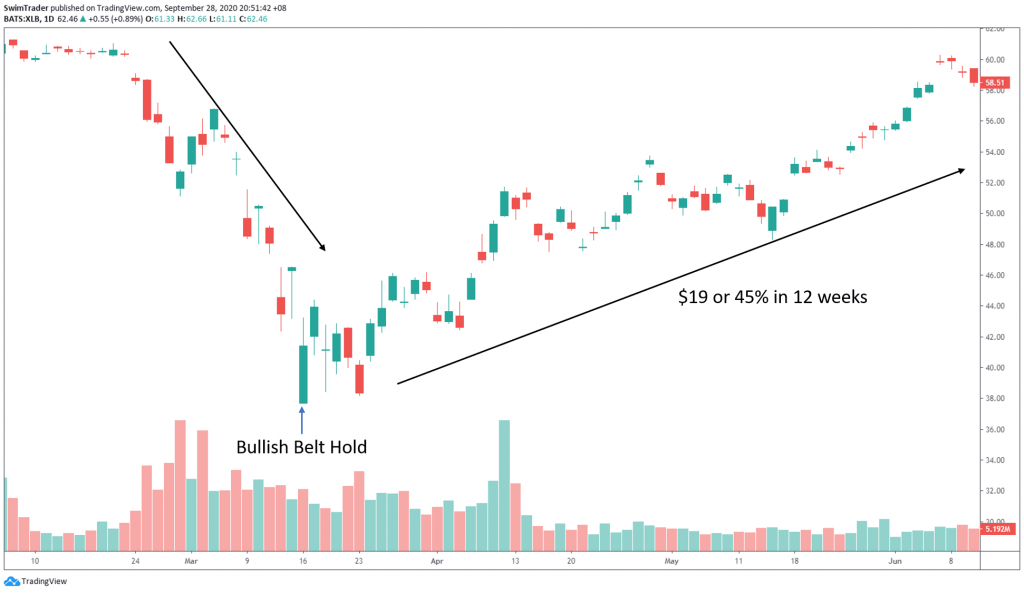

Let’s have a look at the Bullish Belt Hold candlestick pattern in real-life. The Bullish Belt Hold candlestick pattern appeared on the chart of XLB in mid-March 2020.

In this example, prices ranged for a week after the Bullish Belt Hold candlestick pattern showed up. Prices shot up thereafter. How much did prices shoot up? $19 or 45% in 12 weeks!

Let’s analyze what went on while the Bullish Belt Hold candlestick pattern was being formed.

Price opened lower, and the bulls took over immediately. This caused prices to rise.

There was little to no resistance from the bears, and the bulls won comfortably that day. The bulls won by a huge margin, closing at the high of that session, forming a Marubozu candlestick (shown by the green candle body).

This meant that the strength of the bulls is overpowering and prices are ready to range or move upwards.

Similar to the Hammer candlestick pattern, pay attention to the volume too. A high volume day is a strong indication that the Bullish Belt Hold is a valid bullish reversal candlestick pattern.

#3 Bullish Engulfing

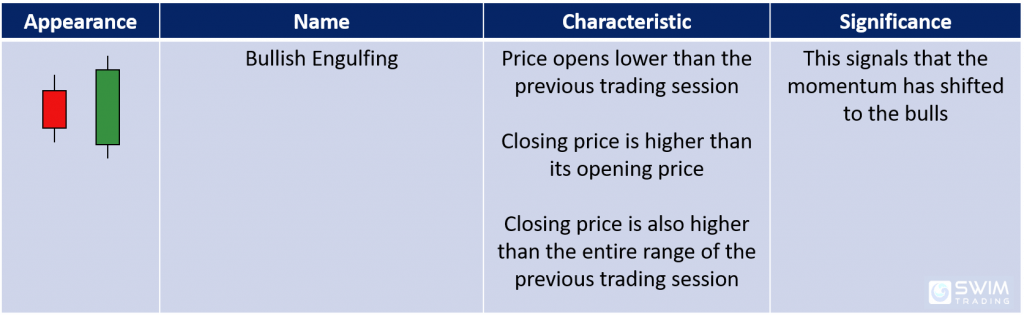

You’ll learn of the 3 characteristics of a Bullish Engulfing candlestick pattern and its significance from the table below.

For a Bullish Engulfing candlestick pattern to be a valid bullish reversal, its opening price must be below the previous candle’s closing price (ie there’s a gap down). This chart pattern must also be formed at a low.

Trading Psychology

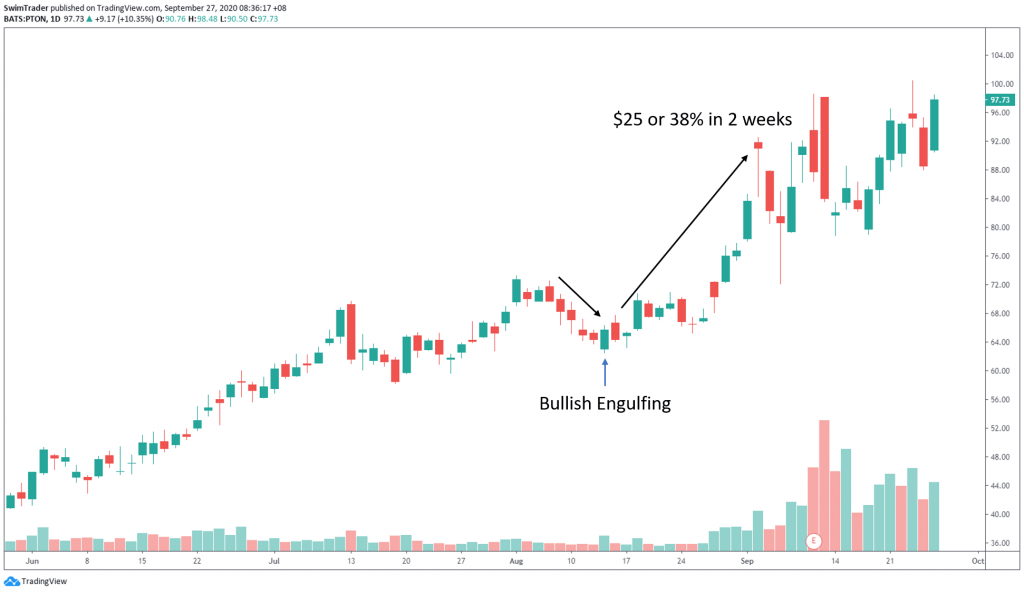

The Bullish Engulfing candlestick pattern appeared on the chart of PTON in mid-August 2020.

The prices of PTON ranged for 2 days before shooting up by $25 (or 38%) in 2 weeks.

Here’s an analysis of what happened while the Bullish Engulfing candlestick pattern was forming.

During the decline in prices, there was a gap down. The bears continued to push prices lower, causing a lower wick/shadow to form.

The strength of the bears weakened and the bulls took over. The bulls pushed prices up well beyond the high of the previous day. This sparked a tough fight between the bulls and bears on the next day. The bears attempted to push prices lower and the closing price was lower than its opening price for that day.

But the bears soon ran out of steam and an uptrend began.

Again, high volume of trading activity increases the chance of success.

4 Things You Must Remember About These Candlestick Patterns

#1 There must be a gap down

#2 Prices may range for a short while before a new uptrend forms

#3 An immediate bullish reversal may happen

#4 High volume enhances the rate of success

Come back next week for Part 2 where I’ll share more bullish reversal candlestick patterns which you can profit from!

Here’s What You Can Do To Improve Your Trading Right Now

#1 Register for our market outlook webinars by clicking here

#2 Join us in our Facebook Group as we can discuss the various ways of applying this by clicking here

#3 Never miss another market update; get it delivered to you via Telegram by clicking here

#4 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

Trade safe!