Not all triangle patterns are as powerful and reliable. In fact, triangle patterns often fail to deliver. However, there are 3 secret characteristics of those which are highly reliable. The profits that these triangles bring are usually massive, out-sizing the amount of risk.

Before diving in to the 3 secret characteristics, you’ll need to know how triangle chart patterns look like and the 2 most common types of triangles.

Spot It Right

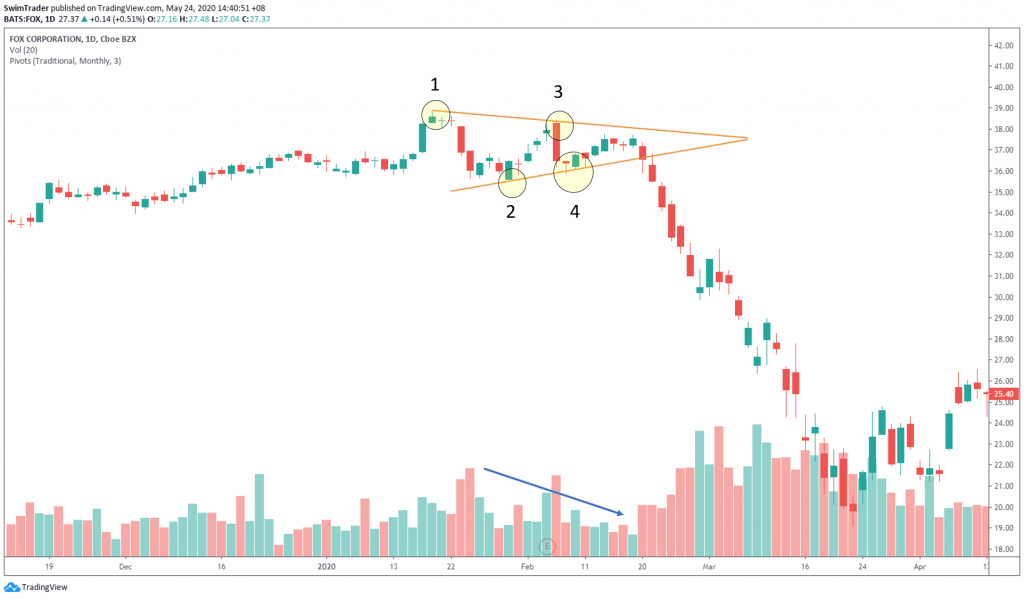

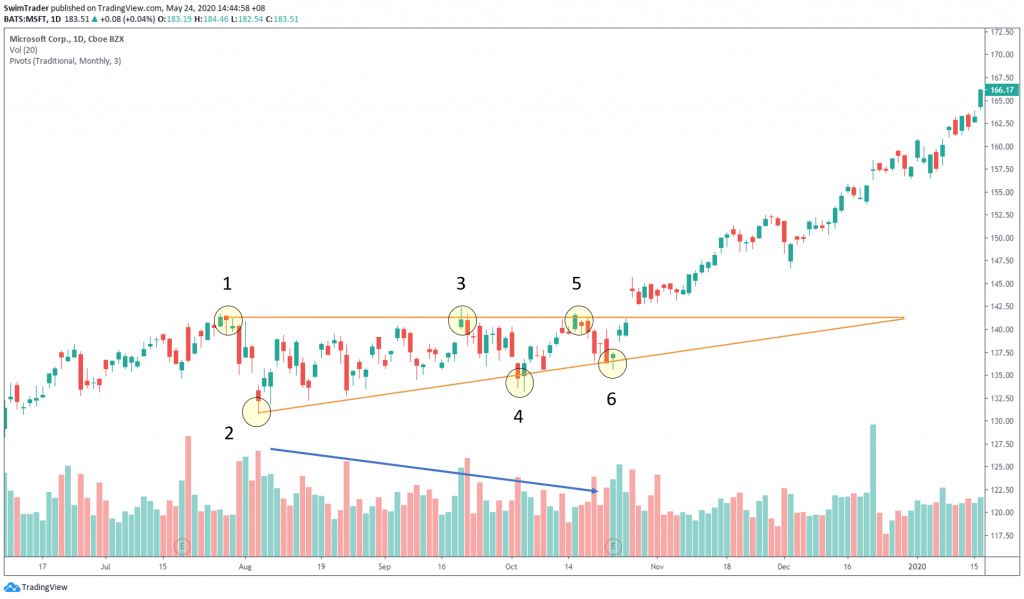

#1 Ideal Symmetrical Triangle

Characteristics

- At least 4 swings (up and down)

- Each peak is lower than the previous and each bottom higher than the previous

- Prices and volume diminish as the pattern is formed

- Prices and (usually) volume move sharply upon the breakout (only for a bullish breakout)

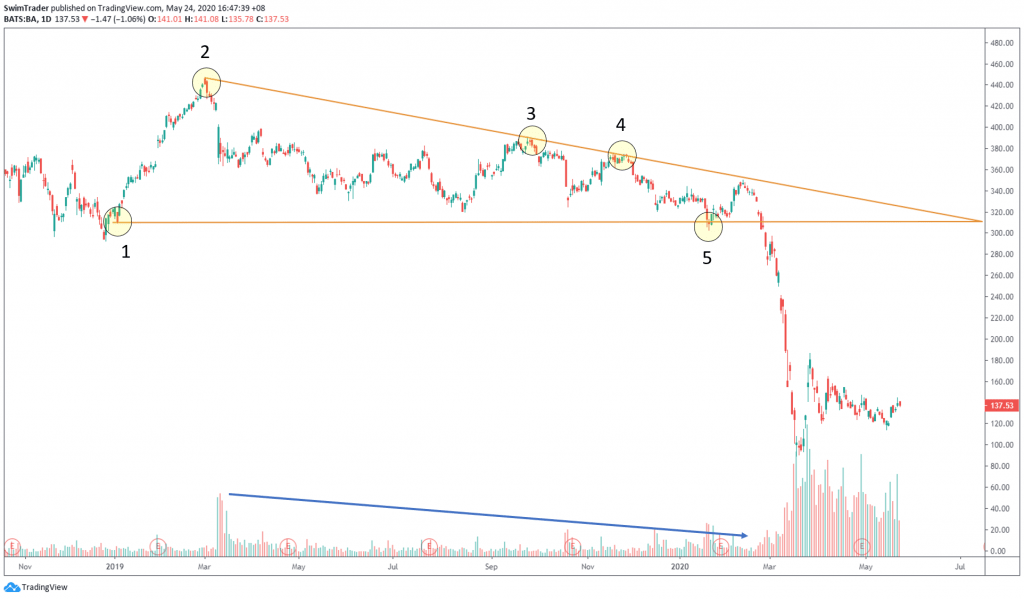

#3 Ideal Right-Angled Triangle

Characteristics

- At least 4 swings (up and down), with one of the lines being horizontal, hence the name of this triangle pattern

- Each peak is lower than the previous and each bottom higher than the previous

- Prices and volume diminish as the pattern is formed

- Prices and (usually) volume move sharply upon the breakout (only for a bullish breakout)

What Happens Inside The Triangles?

In a bullish triangle, the bulls an bears are having a massive fight. Initially, the bulls look to be winning, but the bears won’t give up without a fight. As the bulls push prices up to a certain level, the bears step in, pushing prices down. The same cycle repeats, forming a triangle.

In a bearish triangle, the bears force prices down before the bulls wake up to push prices back up. This cycle repeats, forming a triangle.

3 Secret Characteristics

You have learnt how to identify and differentiate the 2 main types of triangles. You are ready to discover what the 3 secret characteristics are.

These 3 secret characteristics improve the reliability of the pattern:

- The nearer the breakout occurs to the apex, the better

- The more prices touch the lines, the better

- Be wary if the volume is low during the bullish breakout

Show Me The Money

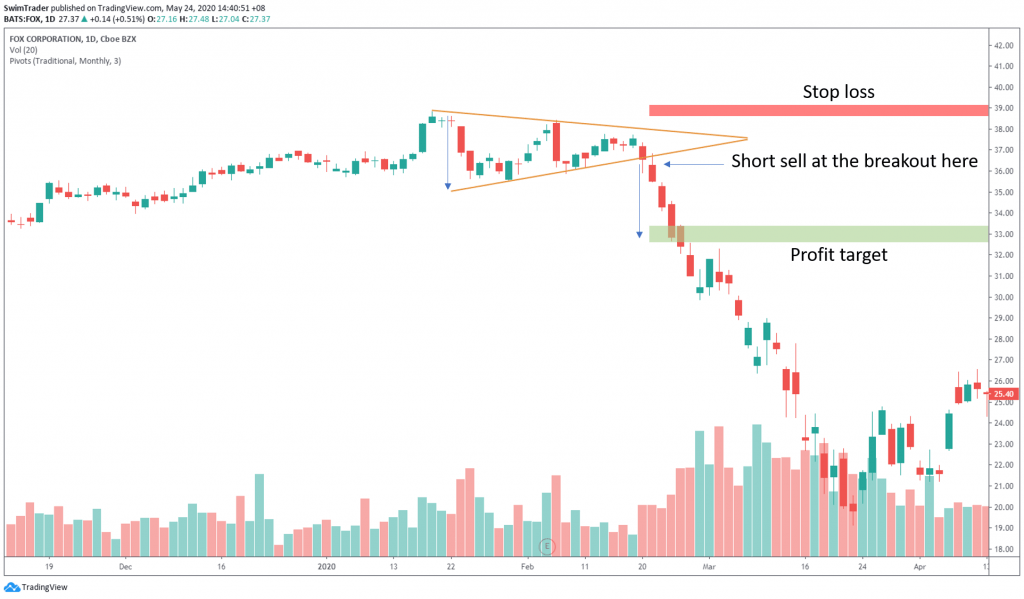

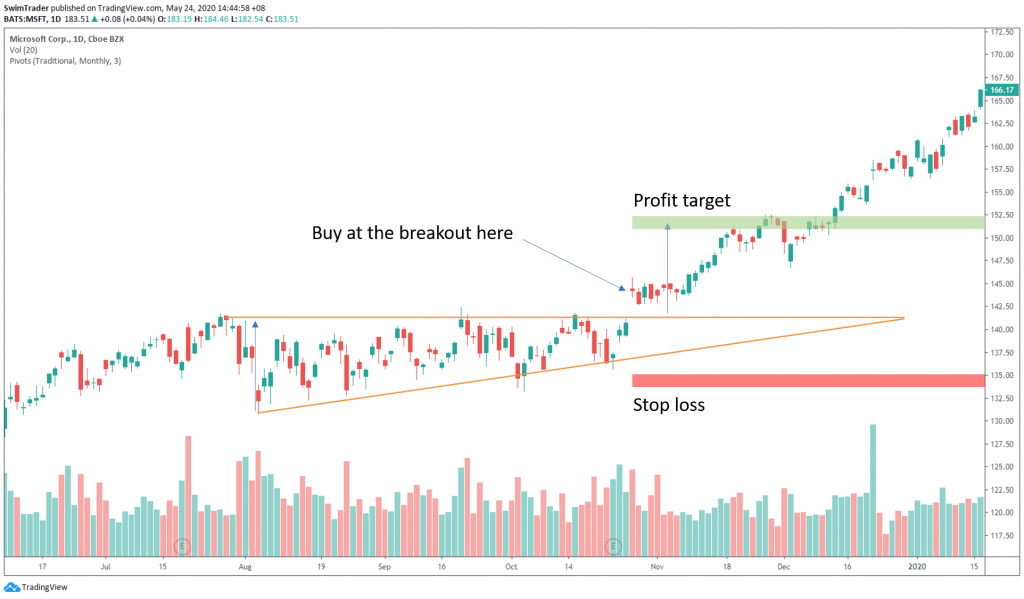

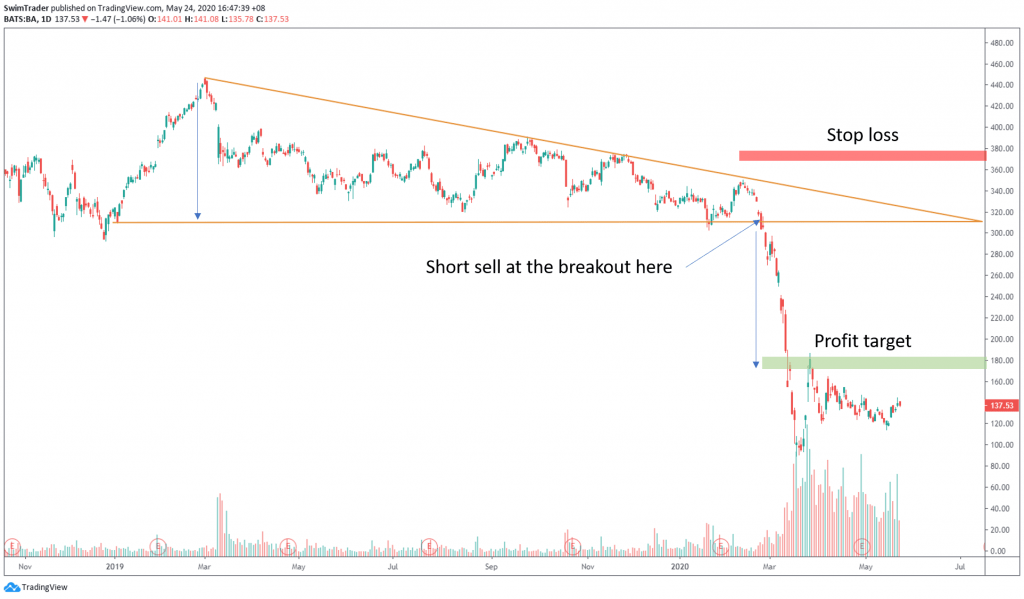

Only trade breakouts.

Steps:

- Watch for price to break the triangle pattern line

- Enter your position according to the direction of the breakout the next session

- If you are trading using the hourly chart, enter the trade an hour later

- If you are trading according to a daily chart, enter the trade on the next day

- Set your stop loss

- Set a profit target (based on the height of the triangle as shown)

- Yes, you may set your profit target farther out for more profits

Conclusion

After spotting a triangle pattern, look for the 3 secret characteristics. Take a position if they are present and this might just be your best trade of the year.

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Register for our market outlook webinars by clicking here

#2 Join us in our Facebook Group as we can discuss the various ways of applying this by clicking here

#3 Never miss another market update; get it delivered to you via Telegram by clicking here

#4 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

Trade safe!