Exits are as important as entries. A stop loss can protect you from a potential collapse in the stock market. No one likes to be stopped out prematurely, missing a massive trend.

How do you know where to place your stop loss to catch the bulk of the trend? This question has been haunting me for a long time.

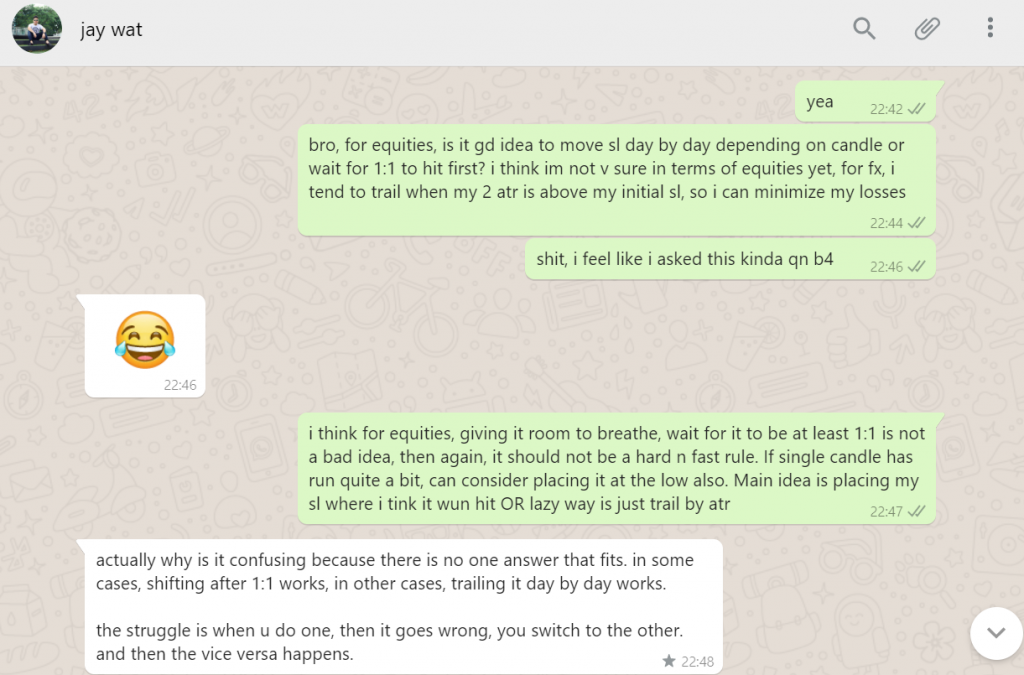

If you are new to trading, you may identify with my struggles and thoughts as described in the screenshots below. The screenshots are the conversations between our trainers.

Advice From Conversations Between Our Traders

Should I place my stop loss to get a 1:1 risk to reward ratio? Should I place it farther to increase my win rate?

These are some captures of a trader’s struggle. And the take away is that it is best to select a stop loss level that is based on price action and volatility.

The 4 Secrets

#1 Previous Previous Day’s Low

If you were to go long on BSX tomorrow, then a good place to put your stop loss level is where the previous previous day low as shown by the pink arrow.

The blue arrow indicates the latest low.

#2 Market Structure

Look for support and resistance zones and place your stop loss below those zones. Here, the immediate support zone of BSX is too near for my comfort level. I’d prefer to move the stop loss level down to just below the previous support zone (red zone).

#3 1 ATR (Average True Range) Below Recent Low

ATR is an indicator that measures the volatility of prices. The default duration is 14 periods. Add 1 ATR to the latest support zone and place your stop loss there (red zone).

#4 Positional SL%

At times, prices may pullback and pierce through the support zone. This will trigger your stop loss if you use Approach 1. To add salt to your wound, the price rebounds and takes off without you. To avoid this, I use the Positional SL% indicator to tell me where to place my stop loss. This is a proprietary indicator that’s only available to my paid students.

A Trader’s Usual Mistakes

They are used to changing their approach when it was not working out, as you’ve witnessed from the chat above.

I used to set my stop loss level based on the previous previous day’s low. When I get stopped out, would switch to Approach 2.

This reduces the number of shares I purchase (position size). This means that I make less money when prices go my way. Frustrated, I revert back to Approach 1 and get stopped out easily again.

As an idealist, I took trades that had a reward to risk ratio of 1:1 or better, combining it with Approach 4. This approach also reduced my profit, given the small position size.

Keys To Note

Now as I set my stops, I do not worry about making money, I ask myself, “am I okay with losing/risking this amount of money?” If the answer is yes, I go ahead with the trade.

Sometimes a risk to reward ratio of 2:1 is fine with me when it comes to buying stocks. I am comfortable with holding on to the stock until the market proves me wrong. The main idea is to be comfortable with your plan.

Conclusion

Remember that a stop loss is where you believe prices should not hit in a given market. If it does, take the loss and move on.

If it gets hit too often, review your trades and adjust/reflect so that you can adapt it to prevailing market conditions.

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Join us in our Facebook Group and share your questions as we learn and grow.

#2 Never miss another market update; get it delivered to you via Telegram.

#3 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only).

See you around!